Returned Checks

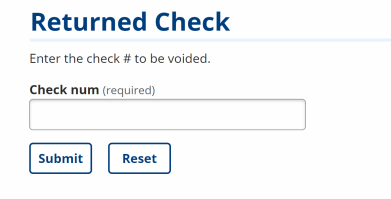

If, for whatever reason, a check is returned by a job seeker or vendor and must be voided, the Fiscal main menu item Returned Check should be used. Enter the check number and click Submit.

Provided the check number is valid, can be accessed by the current fiscal rep, and has not already been voided, FiscalLink returns a confirmation page containing data on each payment that was associated with the check number. The final row of the table contains the total sum of the check, which should be double-checked against the check amount for an exact match.

Voiding a check results in a new row for each expense covered in the check. The new row will be an exact copy of the original, except for a negative amount in the expense column and no voucher information. The negative payment amounts “zero-out” the check, returning the money to the available budget. The negative payments will also be sent on to the paymaster to update the money amount available for mailing.